The Ultimate Guide to Content Marketing for Venture Capital Firms

-min.jpg)

-min.jpg)

The top 2% of venture capital firms capture 95% of returns.

If your firm is not in the 2%, you have a problem.

That problem could be a lack of visibility, an underdeveloped brand or reputation, an unclear differentiator or value-add, or a combination thereof.

The best founders want to work with the most reputable VC firms, period.

Everyone else will find their way to less reputable firms which usually means sub-par returns.

In fact, the chasm between top-quartile and bottom-quartile VC funds is huge.

According to Cambridge Associates, in the 10 years to 2018, top quartile funds recorded an average IRR of 22.76% whereas bottom quartile funds recorded 5.47%.

If you were a bottom quartile fund, your LPs would have been better off putting their money into an S&P500 index fund, generating 6.79% returns over the decade.

Hard to imagine in a decade that saw a Cambrian explosion in high-speed broadband, cloud, social, and mobile, and some of the best venture returns ever recorded.

But that’s the result of a weak brand capturing weak deal flow.

As the old saying goes, sh*t rolls downhill. 💩

The cost of missing out on just one home run deal can sacrifice half of a fund's potential returns, yet the cost of doing content is a drop in the ocean of a typical firm's management fee.

This is why more VCs are now turning to content to build their brands, visibility, and reputation, broadcast their value add and personalities, and compel the best founders to want to work with them.

But most VCs that do content or are doing it poorly, inconsistently or both, making their efforts redundant and counterproductive.

This is a lost opportunity.

And in the competitive world of venture capital where you are investing other people’s money, it’s borderline negligent.

This guide provides you with a comprehensive step-by-step process for creating a content machine that works while you sleep, one that consistently churns out high-quality content, engages your target audience, helps you build quality relationships, a solid pipeline of LPs, and quality deal flow.

Let’s get started.

Content marketing is essentially about creating and sharing valuable, relevant, and engaging content to attract, inform, and engage your audience.

The goal? For VC firms, it’s to build key relationships, raise capital, get on the cap table of high-potential companies, and ultimately, generate target returns.

But it's not about hard-selling.

Doing content right is about building trust and providing real value.

It's a long game. It's a marathon, not a sprint. You need to channel your inner Eliud Kipchoge instead of your Usain Bolt.

Whether it's a well-crafted blog post, an insightful podcast, a compelling video series, tweet threads that people actually read, or a well-researched white paper that addresses your target audiences pain points, content is how you can position your firm to move into the top 2% of firms capturing the lion’s share of returns.

Traditional marketing is often invasive, and self-centered. It's the unsolicited cold call, the annoying pop-up ad, or the conference sponsorship.

It's all about pushing your message onto an audience, hoping it sticks. And more often than not, it doesn’t.

Content marketing is different. It requires finesse. And it has a lot more to do with providing value and entertainment to your audience than it does glorifying your brand.

It's the blog post that answers a burning question, the informative video that solves a problem, or the podcast that entertains and educates. It's about building trust, authority, and genuine connections with your audience.

50/20/20/10 is an oft-parroted rule in the content marketing world.

Content marketing understands that people are savvy and don't want to be sold to; they want to be informed, entertained, and inspired.

It's a strategy that respects the intelligence of your target audience - especially true if your audience is tech founders, prospective LPs, and other venture capitalists.

Content isn't easy. Numerous venture firms have started publishing podcast episodes - but stopped doing so after seven or so episodes (a phenomena known as podfading).

Perhaps they started publishing blog posts, but stopped doing so back in February of 2022.

Unless you already have a massive mailing list and online following - and if you’re reading this you probably don’t - you won’t get immediate engagement. And this can set the scene for premature quitting.

Content marketing success boils down to the following:

As former US President, Calvin Coolidge said, “nothing in this world will take the place of persistence”.

And as a VC, you know this well.

Successfully raising a venture fund, where you might hear “yes” for every five to ten “nos” over a period of two years to close your first fund, requires a ton of heart and persistence.

Blackbird VC’s Niki Scevak met with 522 prospective limited partners over two years, with just 96 saying yes to the firm’s $29M Fund I (hear our interview with him below).

And content is no different.

If you want to succeed at building an awesome venture capital brand with content, you’ve got to play the long game.

But this doesn’t mean grinning and bearing your way through it.

It means cultivating a solid strategy and system to empower your firm to churn out engaging content consistently.

Depending on where your firm is at, your goals will vary.

You might start with some broader goals such as brand awareness and deal flow, then drill down to some more specific leading indicators, such as generate 100 inbound deal flow leads per month.

And finally, trailing indicators or end goals, such as generating 25% IRR.

Of course, content won’t be solely responsible for your returns but it can play a big part.

Other factors that determine this is how well you do your DD and pick, how well you and your fellow investors help startups grow, other things you do to generate deal flow such as get on the phone, attend conferences, and so on, and of course, good old-fashioned luck.

Here’s a deeper look at how to think about your objectives.

Before diving into the creation of content, ask yourself, "Why are we doing this, and what do we hope to achieve?"

Your objectives should be specific, measurable, achievable, relevant, and time-bound (SMART).

.png)

Your objectives are the compass guiding your content journey. Choose them wisely, measure diligently, and adjust as needed.

Your audience is everything.

But how can you create content that truly resonates if you don't know who you're talking to? This is where target personas come into play.

The type of content that engages a seed stage founder versus a Series C founder will be different.

The type of content that engages a single family office versus an institutional investor will also be different.

You need to get clear on who you’re targeting, where they hang out online, what drives them, what keeps them up at night, and so on.

Here’s how we think about personas.

.png)

This question is huge. Are they on Twitter, LinkedIn, Instagram, Reddit?

Are they hanging outin invite-only Whatsapp groups?

Are they on Discourse or Slack channels?

Are they part of specific groups on various social networks?

How can you best reach them?

What kind of content best reaches them on these platforms?

The answer will depend on your clearly defined target persona.

Find below some places you might find founders online.

However, a prospective limited partner (LP) might hang out in totally different places online, such as the following.

Creating target personas is not about stereotypes but empathy. It's about stepping into the shoes of your audience and seeing the world from their perspective.

When you truly understand your personas, you can craft content that addresses their needs, desires, and problems.

1. Imagine you're a B2B SaaS collaboration company targeting small business owners. One of your target personas could be Sarah, a 35-year-old mother of two, running a digital marketing agency. She's goal-oriented, and values time with her family. Her pain points juggling work life with family life. By creating content that directly speaks to Sarah's challenges and goals, you can build a stronger connection with her and engage her.

In this case, an article on 10 Ways for Boss Moms to Create Work-Family Harmony is more likely to engage her. Naturally, one of those ways will be your product, and how it genuinely can help boss moms get more done in less time.

2. Alternatively, if you’re an early-stage deep tech VC, you might speak to one of the pain points that most founders feel - raising capital, and prepare a comprehensive list of the Top 100 Deep Tech Investors, segmented by geography, and complete with publicly available contact info. You might choose to feature your firm near the top of the list, or put the list behind a sign-up wall to build your mailing list.

Publishing open-source lists that the general public can help you maintain like these has helped Australia’s AirTree Ventures become a go to resource online for founders in Australia and New Zealand.

Whenever you're about to create content, ask yourself, "Is this relevant to my target personas?" If the answer is a resounding "yes," you're on the right track.

Target personas serve as your North Star, guiding you in content creation, distribution, and engagement. When you create content that truly resonates with your personas, you're more likely to capture their attention and drive desired actions.

Pain points for some of a VCs common target audiences will vary. Find some below.

If I'm building tax management software for startups, then I wouldn't care less about an article on the latest HIPAA regulations.

You’ll want to segment your audience in order to best target and engage them.

For example, you might be a seed stage investor across multiple domains. Perhaps you invest across enterprise SaaS, media, and healthtech.

If this is the case, then producing content on these verticals, as opposed to generic early-stage startup ideas, and distributing the content only to founders in these verticals, is going to resonate much more deeply and get more engagement.

This should filter down to the segmentation of your mailing list as well - but we’ll get to that later.

.png)

Your brand voice is how you express your identity through the words you use, while your style encompasses the visual and emotional elements that define your brand. Together, they shape how your audience perceives you.

Some brands prefer to have a more playful tone, whereas others come across more formal.

Again, it comes down to who they're targeting. Many firms in Asia have websites that mostly speak to conservative LPs and as such are replete with parters wearing suits, legal disclaimes, and very formal, almost drab, language.

We prefer the fun and playful yet still important and valuable content that brands like a16z, Blackbird, and USV put out into the universe. It's more likely to engage the founders your firm wants to back.

While it's essential to be mindful of your brand voice and style, authenticity is key. Your voice and style should genuinely reflect your brand's identity and values. Don't try to be something you're not; instead, amplify your brand's unique characteristics.

A consistent and well-defined brand voice and style build recognition and trust. When your audience encounters your content, they should instantly know it's from you. Trust is cultivated over time through consistent and authentic communication.

Let's get into the nitty-gritty of content formats, and how different VC and tech firms are leveraging these to great effect.

Like most forms of content, you won’t be a great writer from day one.

Practice makes perfect. The more you write, the better you will get.

Writing a lot helps, but so does reading a lot.

And while there are no shortcuts, there are things you can start doing today to make you a much clearer and engaging writer from day one, and avoid common pitfalls.

Scott Adams, the man behind the famous Dilbert cartoons, once penned The Day You Became a Better Writer, and we love it!

Abridged version below.

In summary:

In addition, use sub-headings, bullet-points, clear formatting and visuals to make your content easy to read. Nobody finds a wall of text, devoid of spacing or subheadings inviting nor engaging.

Shorter blog posts of up to 300 words are great for stimulating discussion and engagement, whereas longer posts of 500 to several-thousand words are better for SEO and are more likely to get shared and demonstrate your deep knowledge on an area.

Andreessen Horowitz (a16z) Blog: This well-known VC firm covers a wide range of topics, from technology trends to startup best practices, and maintains entire canons of knowledge on topics ranging from web3, to AI and biotech.

First Round Review: The blog of First Round Capital offers in-depth articles, interviews, and insights from successful entrepreneurs and industry experts. It's an excellent source for startup advice and industry knowledge. The firm’s Medium page boasts over 50,000 followers.

Bessemer Venture Partners Blog: Bessemer's blog features articles on various aspects of the tech industry, often with a focus on SaaS and cloud computing. It's a valuable resource for entrepreneurs and investors.

Greylock Perspectives: Greylock Partners provides a blog that dives into the latest trends and insights in technology and entrepreneurship. Their Grey Matter series features inspiring stories from founders building today’s transformational technologies.

Sequoia Capital Blog: Sequoia Capital's blog covers a broad range of topics, including startup growth strategies, industry trends, and leadership insights. It's a treasure trove of knowledge for entrepreneurs.

Union Square Ventures Blog: USV's blog explores the world of venture capital and technology with a focus on the impact of blockchain, AI, and more. It offers insights into the ever-evolving tech landscape.

Foundry Group Blog: Foundry Group's blog provides valuable insights into the world of venture capital and startup investing. They often share their experiences and knowledge to help other founders and investors.

True Ventures Blog: True Ventures offers a blog that features articles on a wide range of topics, from design and culture to technology trends and startup advice.

Essays by Paul Graham: The Y-Combinator founder has been a prolific writer for decades on the inner workings and nuances of building a startup. His essays have also helped to further establish Graham as an iconoclast in the tech world.

Don’t forget to optimize your blogs for lead capture. If someone is enjoying what they read, a simple ‘sign up to our fortnightly newsletter’ option that is sticky and always on the screen will compel more readers to join your mailing list, ensuring your firm becomes and stays front of mind as a venture brand name - providing you continue to produce and publish compelling content. More on lead magnets later, though!

Creating compelling blog content is only half the battle. To ensure that your content reaches its full potential, you need to optimize it for search engines. Search Engine Optimization (SEO) can significantly boost the visibility of your blog and drive organic traffic. In this chapter, we'll explore the art and science of SEO optimization for your blogs.

There's a ton on the interwebs on optimizing your content, so find below a high-level crash course. For more on SEO, check out this resource from SEMRush.

Keyword Research: Start by researching relevant keywords for your blog topic. Tools like Google Keyword Planner, SEMrush, or Ahrefs can help identify high-value keywords that align with your content.Some examples below.

Use Headers: Break your content into sections with clear headers and subheadings. This not only improves readability but also allows search engines to understand the structure of your content.

In-Depth Content: Search engines tend to favor comprehensive, in-depth content that answers users' questions thoroughly.

Originality: Original content is crucial for SEO. Avoid duplicating content from other sources, as this can lead to lower search rankings.

Quality Over Quantity: While consistency is important, quality should always be your top priority. One well-optimized, high-quality blog post can outperform multiple low-quality posts.

Meta Tags: Optimize your blog's meta title and meta description to include your target keywords.

URL Structure: Create clean and concise URLs that include keywords when possible.

Image Optimization: Use descriptive alt tags for images. and compress images so they load quickly.

Internal and External Links: Link to relevant internal pages on your website and include outbound links to reputable sources.

Responsive Design: Ensure your blog and website are responsive and mobile-friendly.

Page Speed: Optimize your blog's load time. Slow-loading pages can result in higher bounce rates and lower search rankings.

User Experience: Create a user-friendly design that's easy to navigate. Search engines consider user experience factors when ranking content.

Fresh Content: Regularly update and refresh your blog with new content. Search engines prefer sites that consistently provide fresh, relevant information.

Backlinks: Backlinks from reputable and relevant websites signal to search engines that your content is valuable and trustworthy. This can lead to higher rankings in search results and increased visibility.

SEO optimization is an ongoing process. It requires a combination of strategic keyword usage, quality content creation, technical improvements, and a commitment to providing the best possible user experience. In the upcoming chapters, we'll explore content distribution, engagement, and measurement, ensuring that your optimized blogs reach and resonate with your target audience.

While blogs and articles are excellent for sharing insights and quick tips, whitepapers and ebooks (like this one) allow you to explore complex topics in-depth and provide comprehensive resources for your audience.

Above all, they’re an opportunity to both showcase your expertise and get people onto your mailing list, granting you the permission to engage them and cultivate a relationship.

While not a VC firm per se, technology market intelligence platform CBInsights uses downloadable whitepapers and reports to builds its mailing list.

It offers readers a sneak peek of what’s in a report with some highlight stats, serving as a prompt to compel readers to see the value and download the report.

Not only that, but CBInsights delivers much of its content with an entertaining and friendly tone - making it stand out in a market intelligence landscape that’s usually typified by boring, dry, and formal language. The company's founder Anand Sanwal always signs off from his frequent subscriber newsletters with asimple "I love you".

Another example we love is Bessemer Venture Partners. The firm releases whitepapers and research reports that cover SaaS (Software as a Service) trends and cloud computing. These reports offer valuable insights for entrepreneurs and investors.

Bessemer also repurposes its reports into video presentations, but more on repurposing later!

Finally, we can't talk a savvy use of reports without mentioning Angelist. The company's frequent reports on the state of the venture & startup ecosystem have become ago-to for founders, VCs, and LPs alike.

The beauty of podcasts is that you can listen to them anywhere - going for a walk, in the gym, in the car, and so on. That’s why theyve become one of the most popular mediums in the world.

As of mid 2023, there are 464.7 million podcast listeners globally as of 2023. This number is predicted to reach 504.9 million by 2024. The podcast industry market size is $23.56 billion.

And the best VC firms know this.

Unlike blogs, whitepapers, or email newsletters, podcasts give us perhaps the best vehicle to develop an intimate connection with the listener.

Think about the podcasts you listen to. You probably feel like you kinda know the hosts, even though you’ve never met them.

You’re literally getting inside the head ofyour audience for 30 or more minutes a week. After a while, your audience will begin to feel that same sense of familiarity and trust with you that you feel with your favourite podcasters.

Other mediums simply don’t do this - not even video, which is nowhere near as consumable on-the-go.

Podcasts can be short form (up to 5 to minutes) or long form (up to several hours), and are typically one of the following:

Content Relevance: Ensure that your podcast content aligns with the interests and needs of your target audience.

Quality Production: Invest in high-quality production to create an engaging listening experience. This doesn’t need to break the bank, by the way. A couple of quality microphones and audio interface is usually enough, and that will only set you back several hundred dollars. Whether it’s a Behringer setup for $300 or so, or a slightly better Zoom setup, crystal clear, booming sound doesn’t require an expensive studio and producer.

Consistency: Most podcasters 'podfade', a phenomenom that sees most give up after just seven episodes. Content is a longgame. Commit to at least 100 episodes and a consistent publishing schedule.

Start big: It has been alleged for many years now that Apple Podcasts favours new shows that start with a handful of episodes (7 or more) instead of just one, and that by doing soyour show has abetter chance of ending up on Apple's New & Noteworthy list, and even the charts, which can help more people discover your show and hopefully, subscribe.

When it comes to software, Audacity is great for recording in person, whereas most video conferencing tools such as Zoom have built-in recording functions to capture audio and video. In terms of hosting, Acast is great if you plan to monetize your show with ads, whereas Substack offers a free hosting service that also does a great job of producing transcriptions and marketing snippets for you. There are numerous other players on the market, too.

Again, tie it back to the goals and target audience you defined earlier.

Dive into candid and concise conversations with some of the world's most successful venture capitalists, entrepreneurs, and startup experts. Harry Stebbings delves into a variety of topics, from the latest trends in tech to valuable investment advice.

Now hosted by Stephanie Smith, author of Doing Content Right, the a16z podcast features the renowned venture capital firm Andreessen Horowitz, discussing tech trends, culture, and business. Explore in-depth discussions on everything from AI and blockchain to the future of work. The firm not only has one podcast, but an entire podcast network covering myriad topics of interest to tech founders,. below

Join LinkedIn co-founder and venture capitalist Reid Hoffman as he explores the stories of entrepreneurs who scaled their startups into industry giants. The podcast provides actionable insights and lessons for founders and investors alike.

into deep discussions about technology, startups, and the future of venture capital with this group of seasoned investors and entrepreneurs.

Produced by Y Combinator, one of the world's leading startup accelerators, this evergreen podcast offers a comprehensive guide to starting a successful tech company.

Explore the fascinating stories behind tech acquisitions and IPOs. Ben Gilbert and David Rosenthal provide deep insights into the deals that have shaped the technology industry, researching for weeks the companies they profile and occasionally interviewing the founders behind them.

Hosted by SonicBoom's Steve Glaveski. Learn from conversations with world-leading venture capitalists, entrepreneurs, and thinkers as diverse as Jason Calacanis, Scott Galloway, Jason Fried, Brad Feld, and Tyler Cowen.

Get a front-row seat to the thrilling world of startup pitches. Entrepreneurs present their business ideas to a panel of investors, offering a unique look into the funding process.

Nick Moran dives deep into the intricacies of venture capital and entrepreneurship. The podcast features experienced VCs and founders sharing their wisdom and experiences.

FirstMark Cap's Matt Turck interviews founders on all things machine learning, AI, and data. Get it?

Hosted by Jason Calacanis

Jason Calacanis, an angel investor and entrepreneur, discusses startups, angel investing, and technology. Tune in for insightful interviews with industry leaders. Now over 14 years and 1,800 episodes strong!

Hosted by Alex Wilhelm and Natasha Mascarenhas

Part of TechCrunch, this podcast focuses on venture capital, startups, and the financial side of tech. Stay informed about recent funding rounds and market trends.

Video has become one of the most effective mediums to reach and engage people, especially as far as SEO is concerned, with YouTube videos ranking prominently in search engine results ever since it was acquired by Google.

Video takes a lot more effort, but that effort can often be repad with greater returns.

Engagement: Video content is more engaging and memorable. Viewers tend to retain information better when it's presented visually.

Social Media Appeal: Videos perform well on social media platforms like Instagram, Twitter, and TikTok. They tend to receive more likes, shares, and comments, increasing your content's reach.

Storytelling: Videos allow you to tell a compelling brand or product story, connecting with your audience on an emotional level.

When incorporating videos into your content strategy, consider these popular formats:

Explainer Videos: These videos simplify complex concepts, making them ideal for showcasing your product's features or explaining industry-related topics (find our own explainer video below).

Interviews: Conduct interviews with industry experts, thought leaders, or satisfied customers to provide valuable insights and credibility.

Webinars: Host webinars to delve into specific subjects, answer questions, and engage with your audience in real time.

Product Demos: Showcase your product or service in action, highlighting its benefits and functionality.

How-To Guides: Create step-by-step tutorials and guides to educate your audience on various topics, positioning your brand as a helpful resource.

Podcast videos: Many podcasters are turning to well-produced video content to help them stand out in a saturated audio podcast market. However, this comes with both added cost and workload, and can be hard to justifiably sustain unless you’re getting traction.

Behind-the-Scenes: Take viewers behind the scenes of your business to humanize your brand and build trust.

To create effective videos, consider these best practices:

Quality Production: Invest in good equipment and video editing tools for high-quality videos.

If all you’re doing is online interviews, then an affordable HD webcam with 1080p recording, a $50 green screen, $50 ring light, and $200 Blue Yeti microphone can make a massive difference to the quality of your videos.

But if you’re recording an in-person show with camera switching, then you’ll need to spend a few thousand dollars for something more high-end, or pay a video-production agency to manage the process for you. Not to mention using a space that is video-friendly and reflects well on your brand.

As far as software goes, if you want to get fance you can use streaming software such as OBS to make your videos more engaging, and stream live. Again, this is something you might seek out training or support with depending on your budget and appetite.

Scripting: Plan your video's content with a clear and engaging script. Be concise and avoid unnecessary jargon. Use hooks. Keep it short and succinct. Don't dawdle. Drive the viewer forward.

If you’re using YouTube and other video platforms, compelling thumbnails can be the difference between clicks and scroll-bys.

Some quick tips on video thumbnails below:

Use High-Quality Images: Ensure your thumbnail image is clear and high-resolution. Blurry or pixelated thumbnails can deter potential viewers.

Maintain Consistency: Create a consistent style for your thumbnails so viewers can easily recognize your content. Use a similar color scheme, fonts, and layout for all your videos.

Emphasize the Subject: Highlight the main subject or theme of your video prominently in the thumbnail. This should give viewers a clear idea of what to expect.

Contrasting Colors: Use vibrant and contrasting colors to make your thumbnails stand out. Ensure the text and images are easily visible against the background.

Faces and Emotions: If your video features people, try to include their faces and expressive emotions in the thumbnail. Viewers often connect with human emotions.

Build Suspense and Intrigue: The Darkness vocalist Justin Hawkins does this incredibly well with his YouTube thumbnails (below). Here, he has a photo of U2 vocalist Bono with the big bold text IS IT A RIP OFF?, implying Hawkins might think U2’s new material is contentious and ripping off other artists, compelling the user to click on the thumbnail.

Y-Combinator: Boasting over 1 million subscribers, YC’s YouTube channel offers a treasure trove of insights for entrepreneurs - ranging from founder FAQs, interviews, video essays, live pitches, industry news, and so much more. And they’re not afraid to have fun with it, producing entertaining content that won’t necessarily help founders directly - such as their Q&A with Elon Musk on his video game recommendations, which has reached over 6 million views on YouTube.

GV (formerly Google Ventures): GV provides video content, including talks from their GV Design and Engineering teams, offering insights into design and technology.

While tweet threads can sometimes be cringe, self-important, and risk landing you on the @vcscongratulatingthemselves tweet wall of shame, done right, they can be a low investment but high return to engage the tech community where most of them are - Twitter, or uh…X.

Tweet threads enable VC firms to tell engaging stories, share investment journeys, and explain complex topics in a digestible format. VC professionals can establish themselves as thought leaders by sharing valuable insights and commentary on industry trends.

To effectively use tweet threads, consider these best practices:

Engaging Opening: The first tweet should serve as a compelling headline to grab the audience's attention.

Consistency: Maintain a consistent posting schedule and ensure the tweets flow logically.

Visual Elements: Include visuals and multimedia to make the thread more visually appealing. This typically means emojis, but adding some photos or videos that don’t link to third-party websites (actually uploading them) can help.

Hashtags and Mentions: Use relevant hashtags and mention users or firms to increase visibility.

Call to Action (CTA): Encourage engagement with a CTA, such as asking for opinions or retweets.

Timing: Post threads during peak hours to reach a broader audience.

Here are a few examples of how VC firms use tweet threads effectively:

They are also a great way to build not only the firm’s brand, but the personal brands of partners, principals and associates at a firm - just as important when it comes to cultivating relationships with founders, other funders, the media, and industry figure heads at large.

Matt Turck, or as All-In's Chamath Palihapitiya called him on the show, "a guy called Matt Turck", has been capturing the attention of VC Twitter with his unique brand of self-deprecating one liners, memes, VC humor, and the occasional legitimate insights on tech. The managing director of New York's FirstMark Capital now boasts over 80,000 Twitter followers.

Li Jin (@ljin18): Li Jin is a prominent venture capitalist known for her focus on the Creator Economy. As the founder and Managing Partner at Atelier Ventures, she has been a driving force in identifying and investing in startups that empower content creators and digital entrepreneurs. She has over 180,000 followers on Twitter and 34,000 Substack subscribers. Follow her here.

Naval Ravikant (@naval): Naval Ravikant, a prominent angel investor and entrepreneur, is known for his insightful tweet threads on topics like startups, investing, and personal development. You can find his iconic How to Get Rich (without getting lucky) tweet thread here.

Alexis Ohanian (@alexisohanian): The co-founder of Reddit, Alexis Ohanian, often shares meaningful threads about tech, startups, and his experiences as an entrepreneur. Check out his threads here.

a16z (@a16z): The Andreessen Horowitz Twitter account, known for its insightful content, often creates tweet threads on various tech and startup-related topics. You can find their threads here.

Julie Zhuo (@joulee): Julie Zhuo, a former VP of Product Design at Facebook, shares threads on topics related to design, management, and leadership. Explore her threads here.

M.G. Siegler (@mgsiegler): M.G. Siegler, a partner at GV (formerly Google Ventures), is known for his insightful tweets and threads on technology and venture capital. Check out his threads here.

Paul Graham (@paulg): Y-Combinator’s founder is very active on Twitter, weighing in on not only tech and startups, but political and life matters more broadly. Follow him here.

Andrew Chen (@andrewchen): a16z Games Fund partner Andrew Chen shares tweet threads frequently on all things AI, VR, web3 and gaming.

Newsletters have made a significant resurgence in recent years as a powerful tool for content marketing and audience engagement. In this chapter, we'll explore the unique benefits of newsletters and how they can strengthen your content marketing strategy.

Newsletters have become a cornerstone of digital marketing for several reasons:

Ownership: Unlike social media, where your connection to your followers is predicated on a) the social media platform continuing to exist (consider the fall of MySpace or Facebook’s waning popularity), and b) actually serving your content to followers. With email, you own the communication channel, and providing you don’t get blocked, get flagged by email filters as spam, and your subscribers don’t unsubscribe, you can rest assured that about 80% or so of your emails will be delivered.

Reach: The above is not the case on Instagram, where only about 2% of your followers see your stories, and 10% your posts. The percentage can be even lower for many users, sometimes in the low single digits for posts on Instagram, Facebook, Twitter, and LinkedIn.ALl that effort getting followers and people aren’t even seeing your posts?!

Engagement: Unlike social media feeds, where users might find themselves scrolling infinitely past numerous posts that they don’t stop long enough on to engage with in any meaningful way, well crafted and segmented emails will get opened about 20-30% of the time and with in-email links clicked 3-5% of the time.

Audience Segmentation: Newsletters enable you to segment your subscribers based on their geography, interests and behavior, increasing engagement in the process.

Newsletters also ensure that you can have an ongoing dialog with your customers, sending them valuable content on a daily, weekly, fortnightly or monthly basis, and continuing to position your firm positively in your target audience’s mind.

When crafting newsletters, consider these types of content to engage your audience effectively:

To make the most of newsletters, follow these best practices:

Segmentation: Segment your subscriber list to deliver content that aligns with each group's interests.

Engaging Subject Lines: Craft compelling subject lines that encourage subscribers to open your emails. You can use a tool like OmniSend to help you create and test email subject lines.

Consistency: Establish a regular sending schedule to keep subscribers engaged and informed.

Mobile Optimization: Ensure that your newsletters are mobile-friendly, as many subscribers access emails on their smartphones.

A/B Testing: Experiment with different elements of your newsletters, such as subject lines and content formats, to improve engagement.

Analytics Review: Regularly review the performance metrics of your newsletters to make data-driven improvements.

In terms of deliverability, it pays to keep your emails simple. The more bloated they are with visuals, the more likely they are to get picked up in spam filters and the like. Not only that, but a bear bones newsletter can also appear more authentic and personal than one that mimics a Sears catalogue.

StrictlyVC by Connie Loizos: This daily newsletter provides a roundup of tech and VC news. Frequency: Daily.

a16z: Andreessen Horowitz's newsletter shares insights on tech and startups. Frequency: Weekly.

Term Sheet by Fortune: Term Sheet covers venture capital and private equity news. Frequency: Daily.

The Information: Known for its in-depth tech reporting, The Information offers newsletters focused on various tech topics. Frequency: Multiple times per week.

Mattermark Daily by Mattermark: Mattermark's newsletter features data-driven insights on startups and VC. Frequency: Daily.

The Hustle by The Hustle: While not exclusively tech-focused, The Hustle provides a daily business and tech newsletter. Frequency: Daily.

Trends by The Hustle: A sister newsletter to The Hustle, Trends focuses on industry trends and insights. Frequency: Weekly.

Not Boring by Packy McCormick: Not Boring covers tech, business, and innovation. Frequency: Multiple times per week.

Morning Brew: Morning Brew delivers a daily newsletter covering business, tech, and finance news. Frequency: Daily.

There is a plethora of email marketing software on the market, but here are three we like from experience.

Mailchimp: a widely used email marketing platform known for its user-friendly interface. It offers a range of pre-designed templates, automation features, and A/B testing to help businesses create and optimize email campaigns.

Constant Contact: a user-friendly email marketing tool suitable for small businesses. It provides customizable templates, list management, and features for event marketing and social media integration.

HubSpot Marketing Hub: HubSpot's Marketing Hub includes email marketing as part of its comprehensive inbound marketing platform. It offers tools for creating, sending, and tracking emails, along with CRM integration for personalized campaigns.

In the fast-paced world of digital marketing, social media has emerged as a vital platform for engaging with your audience. Short-form content, including social media posts and shorts, can be incredibly effective.

Short-form content, often found on platforms like Twitter, Instagram, TikTok, and LinkedIn, provides unique advantages:

Conciseness: Short-form content forces you to get to the point quickly, making it ideal for capturing attention in today's busy online landscape.

Viral Potential: Short, shareable content has the potential to go viral, increasing your content's reach and visibility.

Real-Time Engagement: Social media posts and shorts offer real-time engagement with your audience, fostering a sense of community.

Mobile-First: Short-form content is often designed for mobile consumption, catering to users on their smartphones.

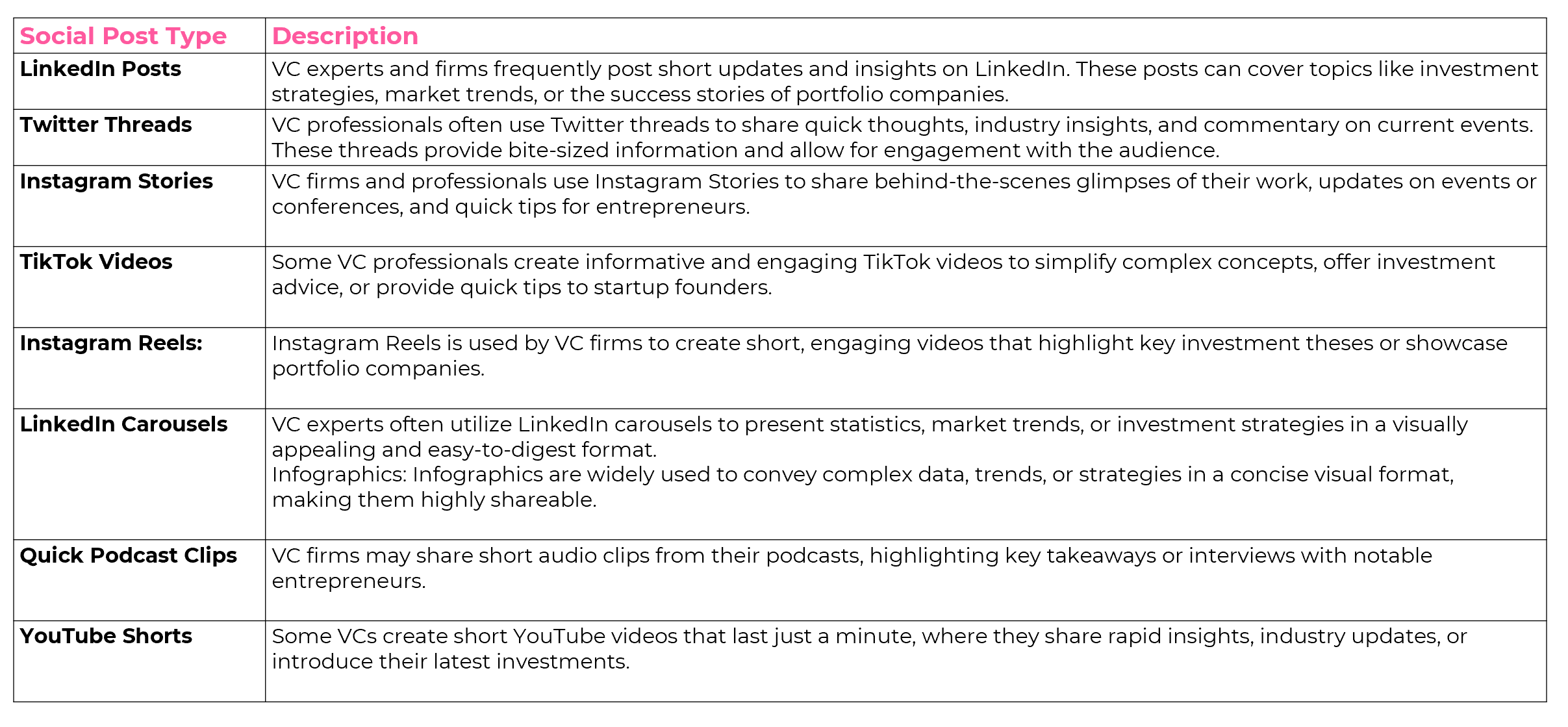

Consider these types of short-form content for your social media marketing strategy:

Here are some good examples of short-form content in the VC industry:

Twitter Threads: VC professionals often use Twitter threads to share quick thoughts, industry insights, and commentary on current events. These threads provide bite-sized information and allow for engagement with the audience.

LinkedIn Posts: VC experts and firms frequently post short updates and insights on LinkedIn. These posts can cover topics like investment strategies, market trends, or the success stories of portfolio companies.

Instagram Stories: VC firms and professionals use Instagram Stories to share behind-the-scenes glimpses of their work, updates on events or conferences, and quick tips for entrepreneurs.

TikTok Videos: Some VC professionals create informative and engaging TikTok videos to simplify complex concepts, offer investment advice, or provide quick tips to startup founders.

Instagram Reels: Instagram Reels is used by VC firms to create short, engaging videos that highlight key investment theses or showcase portfolio companies.

LinkedIn Carousels: VC experts often utilize LinkedIn carousels to present statistics, market trends, or investment strategies in a visually appealing and easy-to-digest format.

Infographics: Infographics are widely used to convey complex data, trends, or strategies in a concise visual format, making them highly shareable.

Quick Podcast Clips: VC firms may share short audio clips from their podcasts, highlighting key takeaways or interviews with notable entrepreneurs.

One-Minute YouTube Shorts: Some VCs create short YouTube videos that last just a minute, where they share rapid insights, industry updates, or introduce their latest investments.

Notably, a TikTok video can triple as a YouTube Short and Instagram Reel or story.

Venture capital firms have a unique opportunity to engage founders and limited partners through educational resources that offer value and insights. These resources not only strengthen the relationship between VCs and their stakeholders but also contribute to the overall growth of the ecosystem.

1. Webinars and Workshops: Host webinars and workshops that cover topics like fundraising strategies, product development, and growth hacking. These interactive sessions allow founders to learn from experts in the field.

2. Startup Playbooks: Develop comprehensive playbooks that guide founders through critical stages of their entrepreneurial journey. These playbooks can cover everything from market research to exit strategies.

3. Founder Stories: Share success stories and lessons learned from the founders of portfolio companies. These narratives inspire and educate, showcasing the real-world challenges and triumphs of entrepreneurship.

4. Investment Insights: Offer founders access to in-depth insights on market trends, investment theses, and opportunities in specific sectors. This information helps founders align their strategies with market dynamics.

5. Online Courses: Create online courses on topics relevant to startup founders, such as business development, leadership, or financial management. These courses can be self-paced and accessible to a broad audience.

6. Case Studies: Develop detailed case studies that highlight how your firm's support and investment contributed to the growth of portfolio companies. These studies serve as testimonials to your value as a VC partner.

1. Investment Reports: Provide LPs with comprehensive investment reports that summarize fund performance, portfolio diversification, and market analysis. These reports aid LPs in making informed decisions.

2. Market Outlooks: Offer regular market outlook reports that analyze industry trends, emerging sectors, and investment opportunities. These insights help LPs stay ahead of market shifts.

3. Webinars and Conferences: Host webinars and virtual conferences where LPs can interact with your team and investment experts. These events allow for direct engagement and knowledge sharing.

4. LP Educational Series: Develop a series of educational resources specifically designed for LPs. These resources can cover the basics of venture capital, investment strategies, and risk management.

5. Impact Reports: Share impact reports that demonstrate the social and economic influence of the VC investments made by your firm. These reports illustrate the positive changes driven by LP capital.

6. Portfolio Insights: Provide LPs with access to insights and updates from portfolio companies. These reports detail the progress and achievements of startups, allowing LPs to track their investments' impact.

Educational resources tailored to founders and LPs create a bridge of trust and engagement between venture capital firms and their stakeholders. By offering valuable, informative content, VC firms can empower founders to succeed and keep LPs informed about their investments' progress and the broader industry landscape.

Lists, preferably open-source, help drive traffic to your website. Tying these lists back to target audience pain points, such as capital raising, will only make it easier to engage users, especially if the lists are updated regularly.

SAP’s corporate venture capital arm, SAP.iO maintains an impressive startup directory (below) - an example of using useful lists to drive inbound traffic.

Visual content, such as infographics and market maps, can be powerful tools for venture capital (VC) firms to convey complex information, trends, and relationships in a highly engaging and easily digestible format.

Infographics are visual representations of data or information designed to make it more understandable and memorable. They are especially effective in the VC industry for the following reasons:

1. Simplifying Complex Concepts: VC often deals with intricate market trends and investment strategies. Infographics simplify these concepts, making them accessible to a broader audience.

2. Engaging Stakeholders: Infographics are eye-catching and shareable, making them ideal for engaging founders, LPs, and the wider tech community. They can be easily shared on social media, in emails, and on websites.

Market maps are visual representations of a specific industry or market, showcasing key players, trends, and relationships. They are particularly valuable in the VC industry for the following reasons:

1. Research: Market maps help founders and investors identify gaps and opportunities in a specific sector. They can pinpoint where innovation is thriving.

2. Portfolio Analysis: VC firms can use market maps to assess their portfolio's positioning within a market. This aids in diversification and decision-making.

3. Due Diligence: Market maps provide a comprehensive view of the competitive landscape, facilitating informed due diligence for potential investments.

4. Communication Tool: Market maps serve as a communication tool to convey market dynamics to LPs and founders, making complex data more accessible.

CBInsights uses market maps to great effect - driving traffic, downloads, mailing list, and subscriber growth.

Here’s one we love on the Cybersecurity market.

Webinars are powerful tools for venture capital (VC) firms to engage founders, limited partners (LPs), and the broader startup community. They provide a dynamic platform for sharing knowledge, discussing industry trends, and building meaningful connections. In this chapter, we'll explore the benefits and best practices of hosting webinars.

Hosting webinars can be a valuable addition to your VC firm's content strategy. Here are some key advantages:

1. Knowledge Sharing: Webinars allow you to share expertise and insights with your audience, positioning your firm as a thought leader in the VC space.

2. Engagement: Webinars provide an interactive platform for direct engagement with founders, LPs, and stakeholders. Participants can ask questions, offer feedback, and actively participate in discussions.

3. Reach: Webinars are accessible to a global audience, enabling you to connect with a diverse range of individuals interested in the startup and VC ecosystem.

4. Thought Leadership: Consistently hosting webinars on relevant topics can establish your firm as a trusted source of information and a key player in the industry.

5. Relationship Building: Webinars offer an opportunity to build and strengthen relationships with founders, LPs, and industry peers, fostering a sense of community.

Hosting webinars can be an effective strategy to educate, engage, and build a sense of community within the VC ecosystem. They provide a platform to share valuable insights, connect with stakeholders, and establish your firm as a respected source of information in the industry.

Content market fit - remember, create types of content that iwll resonate with your target audiences, for platforms that they are on.

Initially you might want to experiment by being everywhere, then doubling down on what works, and pulling back on what doesn’t.

At the same time, numerous content repurposing tools exist that make it relatively easy to create multiple mediums of content from the same piece, allowing you to cast a wider net. But more on that later!

Different types of content can be used to help your firm generates leads - whether its building a founder or LP pipeline.

The effectiveness of a lead magnet depends on how well it aligns with the target audience's needs and interests. Businesses should create and promote lead magnets that genuinely provide value, solving problems or addressing pain points for their potential customers. Once contact information is collected, businesses can nurture leads through email marketing and other strategies to convert them into loyal customers.

So, where do you come up with compelling content ideas and topics? Find some potential sources below.

Team Brainstorms: Organize regular content brainstorming sessions with your team to generate fresh and creative ideas.

Portfolio Companies: Collaborate with portfolio companies to co-create content that highlights their success stories and industry insights.

Market Research: Leverage in-house market research and analysis to create data-driven content on market trends.

Stakeholder Feedback: Gather feedback from founders, LPs, and other stakeholders to identify topics and pain points that resonate with your audience.

Industry Challenges: Focus on addressing industry challenges and concerns shared by your team and stakeholders through informative and insightful content.

By exploring these online and offline sources and collaborating with your team and network, your VC firm can continuously generate content ideas that resonate with your target audience and position your firm as a thought leader in the industry.

You might ask what other VCs and thought leaders from other industries are doing that seems to be working well.

Ultimately, you’ll want to align your content to your target audience and objectives. Speaking to pain points, or topics current interest to founders or LPs can be helpful.

At the same time, it’s important to strike a balance between topical content and evergreen content that can continue to drive traffic and engagement with your brand for weeks, months or even years into the future.-+-

Can be how-to, educational, entertaining, news, current affairs, evergreen, hot takes, better takes etc.

Building a content calendar is an essential component of any effective content marketing strategy. A well-structured content calendar helps you plan, organize, and execute your content efforts consistently.

Here are some steps and tips to help you create a content calendar:

Content Calendar Tools

Select a tool or platform to create and manage your content calendar. Many businesses use spreadsheets, project management software, or dedicated content calendar tools like Trello, Asana, or CoSchedule (more below).

Content Frequency

Decide how often you will publish content. Your schedule might vary depending on your resources, audience expectations, and the platforms you use. Consistency is key.

Plan in Advance

Create a content plan for several months in advance. This allows you to align your content with important dates, holidays, and events relevant to your industry. Having said this, a content calendar is not set in stone. Be ready to adapt to changing circumstances and evolving audience preferences. Regularly review and refine your content calendar.

Assign Responsibilities

Clearly define who is responsible for each piece of content. Assign tasks to writers, designers, videographers, and editors, and set deadlines.

Review and Approval

Implement a review and approval process to ensure the quality and accuracy of your content before publishing.

There are various tools and platforms available to help you create and manage your content calendar. The choice of tools often depends on your specific needs, preferences, and budget. Here are some popular tools and software options:

Microsoft Excel or Google Sheets: Spreadsheets are versatile for creating content calendars. You can customize them to your liking and easily share them with collaborators.

Trello: Trello is a popular project management tool that uses a card-based system. You can create cards for each content piece and move them through different stages (e.g., planning, writing, editing, publishing).

Asana: Asana is a comprehensive project management tool that offers features for creating and managing content calendars, assigning tasks, setting deadlines, and collaborating with team members.

CoSchedule: CoSchedule is a dedicated content calendar and marketing suite. It offers features like social media scheduling, content analytics, and integrations with various platforms.

ContentCal: ContentCal is a social media and content planning tool that helps you schedule and visualize your content. It also offers collaborative features and analytics.

Airtable: Airtable is a powerful hybrid between a spreadsheet and a database, allowing for robust content calendar customization and collaboration. You can use it to track content details, assign responsibilities, and set due dates.

HubSpot Marketing Hub: If you're using HubSpot for inbound marketing, their marketing hub includes a content calendar tool that integrates seamlessly with other marketing activities.

Buffer: While primarily known for social media scheduling, Buffer can also be used to plan and schedule social media content, making it a useful tool for coordinating social media posts with your content calendar.

Notion: Notion is a versatile productivity and collaboration tool that allows you to create custom databases, including content calendars. It's highly adaptable to your specific needs.

Sprout Social: Sprout Social is a social media management platform that offers content calendar features, social media scheduling, analytics, and team collaboration tools.

Choose a tool that aligns with your team's workflow and needs. Some tools are more focused on content creation and scheduling, while others provide a broader set of marketing and project management capabilities. Consider your budget, the size of your team, and the complexity of your content strategy when selecting a content calendar tool.

Legendary ad-man David Ogilvy says that you should spend 50% of your time creating content and the other 50% promoting it and distributing it effectively[2]. This emphasizes the importance of both content creation and distribution.

There’s not much point creating compelling content if nobody sees it, right?

Fortunately, there are numerous tools to help you automatically repurpose and distribute your content across different platforms.

It takes a lot of time to write compelling content. Wouldn’t it be nice if we could take one piece of content and turn it into 10? Fortunately, with repurposing tools we can do exactly that.

Such tools can automatically turn a podcast into a video and written transcript or blog post, they can take videos and turn them into short snippets for social media, they can take long-form articles and ebooks and turn them into bite-sized shareable content and infographics to help drive awareness and traffic.

The beauty of many of these tools is that you can use software like Zapier to get tool A to speak to tool B using APIs, and effectively automate the automaters.

Your audience might not be everywhere though - and a fair chunk of entrepreneurs are on Twitter, but you’ll want to experiment with different platforms to see what works best for your firm.

Creating a content machine that automates the repurposing and redistribution of content across different platforms makes this much easier and more economical to sustain, while ensuring you have a presence virtually everywhere.

20VC’s Harry Stebbings doesn’t stop with posting an episode.

If he’s interviewed a prominent VC, his team will tag other members of the firm in social posts, email them, and do the same with founders of companies the VC has invested it. Everybody will have some inherent incentive to like and/or share the content.

The same can be done with prominent followers of said VC’s content online.

Here, we delve into various strategies that venture capitalists can employ to elevate their content promotion game, from leveraging social media to harnessing the power of email marketing, SEO optimization, influencer outreach, direct outreach, and strategic advertising.

In the digital age, social media has evolved into a powerful tool for engaging with your audience. By actively participating in relevant conversations on platforms like LinkedIn, Twitter, and even niche-specific networks, venture capitalists can amplify their reach. Sharing insightful content, participating in discussions, and building thought leadership can boost credibility and attract potential investment opportunities.

Email marketing remains one of the most effective channels for building and nurturing relationships within the VC ecosystem. From personalized newsletters to curated updates, venture capitalists can use email campaigns to stay connected with startups, inform them about trends, and offer valuable insights.

Search Engine Optimization (SEO) plays a pivotal role in content promotion. Optimizing your content for search engines can help you surface in relevant search results, attracting the right audience. This section will explore on-page and off-page SEO strategies that can improve the discoverability of your content within the VC community.

Venture capitalists can tap into the influential voices within the industry to extend their reach. Partnering with relevant influencers and industry leaders can offer opportunities for co-created content, joint webinars, or simply a mention in their networks. Building these strategic partnerships can expose your content to a broader audience.

Personalized, direct outreach can significantly impact content promotion. Tools and strategies for automating personalized outreach campaigns, while maintaining the human touch, can be a game-changer for venture capitalists. By reaching out to startups and founders directly, VCs can open doors to potential investments. Tools like LinkedIn Sales Navigator, LeadIQ, RocketReach and Hunter.io can all help.

Paid advertising can be a strategic investment to promote your content. Whether through pay-per-click (PPC) campaigns or sponsored content on social media platforms, venture capitalists can achieve increased visibility in front of a precisely targeted audience. This section will explore how to effectively plan and execute advertising campaigns.

Create content that invites participation. Interactive content formats like surveys, polls, quizzes, and contests can be highly engaging. These formats encourage your audience to actively participate and share their opinions or knowledge. For example, you might conduct a survey on the most pressing challenges facing startups in your niche.

Ask open-ended, thought-provoking questions in your content. Encourage your readers or viewers to share their insights and experiences in the comments section or on social media. Questions like "What's your take on the latest trends in tech startups?" can stimulate meaningful discussions.

Host live webinars or Q&A sessions where your audience can ask questions and interact with you in real-time. These events offer a direct line of communication and provide a platform for startups and founders to engage with you directly. Use platforms like Zoom or LinkedIn Live to facilitate these sessions.

Encourage your audience to contribute by sharing their success stories, innovative ideas, or unique challenges. Highlighting user-generated content in your blog, newsletter, or on your social media channels not only fosters engagement but also demonstrates the impact of your work.

Recognize and appreciate your audience's participation. Feature standout comments in your content, give shout-outs on social media, or even organize small rewards or incentives for active participants. This not only acknowledges their contribution but also motivates others to get involved.

Send personalized messages or emails to highly engaged individuals. Acknowledge their participation and express your interest in further collaboration or discussions. This personal touch can go a long way in building relationships.

As famed management thinker Peter Drucker said, if we can measure it we can manage it.

Content success comes down to rapidly creating, promoting, analysing, and improving your content strategy.

KPIs and analytics tools help us do this effectively.

Find below some possible metrics and tools you might use.

In the ever-evolving landscape of venture capital content promotion, making informed decisions is crucial. A/B testing is a powerful strategy that allows venture capitalists to experiment with different content variations and measure their impact. By systematically comparing two versions of content, you can gain insights into what resonates most with your target audience and continually optimize your content strategy. Here's a closer look at A/B testing and how it can lead to data-driven success:

A/B testing, also known as split testing, is a controlled experiment that compares two versions of content to determine which one performs better. In the context of venture capital content, this can involve testing different elements of your content, such as headlines, images, calls to action, or even the overall layout.

A/B testing is invaluable because it replaces guesswork with data-driven decision-making. It provides concrete insights into what aspects of your content are resonating with your audience and what needs improvement. For venture capitalists, this means crafting content that is more compelling, more engaging, and more effective at reaching startups and founders.

Identify Your Goal: Clearly define the goal of your A/B test. Are you trying to increase click-through rates, boost email open rates, or enhance the engagement on your content? Knowing your objective is key to designing an effective test.

Choose a Variable: Select a specific element of your content to test. It could be the subject line of an email, the image accompanying a social media post, or the wording of a call to action in a blog post.

Create Variations: Develop two different versions of the chosen element. One will be the current or control version, and the other will be the variant. Ensure that only one variable is changed to accurately measure its impact.

Randomize and Split: Divide your audience randomly into two groups. One group sees the control version, while the other sees the variant. This randomization eliminates bias.

Measure and Analyze: Use analytics tools to track the performance of each version. Pay attention to relevant metrics, whether it's click-through rates, conversion rates, or engagement levels.

Draw Conclusions: Analyze the data and draw conclusions based on the performance of each version. If the variant outperforms the control, consider implementing the changes permanently.

Venture capitalists can A/B test a variety of content elements:

Email Subject Lines: Test different subject lines to see which ones result in higher open rates.

Call to Action (CTA) Wording: Experiment with the wording of your CTA buttons to boost click-through rates.

Images and Visuals: Test different images in your social media or email campaigns to determine which visuals resonate most with your audience.

Content Length: Assess whether shorter or longer content is more effective for your goals.

Content Layout: Experiment with the layout of your blog posts or newsletters to find the most engaging format.

A/B testing is not a one-and-done process. It's a cycle of continuous improvement. As you gather insights and apply changes based on the results, you can run new A/B tests to further refine your content strategy. This iterative approach leads to content that becomes increasingly effective in achieving your venture capital objectives.

By integrating A/B testing into your content promotion strategy, venture capitalists can refine their approach, optimize their content, and connect with startups and founders more effectively. In the data-driven world of VC, this technique is a valuable asset for those striving for excellence in their content marketing efforts.

Content marketing can be a highly effective strategy for venture capitalists to connect with their target audience and build strong relationships within the startup ecosystem. However, the journey is not without its share of challenges and potential pitfalls. In this chapter, we will explore common content marketing challenges, the mistakes to avoid, the risk of burnout, the perils of inconsistency, the temptation to give up early, and the ever-evolving algorithms. By understanding and addressing these obstacles, venture capitalists can develop a resilient and successful content marketing strategy.

Mistakes are part of the learning process, but some can be costly in the world of content marketing.

Common errors include:

Ignoring Audience Needs: Failing to understand your audience's needs and preferences can lead to disconnected content that falls flat.

Lack of Clear Strategy: Content marketing without a well-defined strategy often results in haphazard efforts and missed opportunities.

Inadequate SEO Optimization: Neglecting SEO can make it difficult for your content to surface in search results.

Overlooking Quality: Prioritizing quantity over quality can dilute your content's impact.

Neglecting Analytics: Not measuring the performance of your content can hinder your ability to make data-driven decisions.

Creating consistent, high-quality content can be exhausting. Burnout is a real risk, and it often results from:

Overcommitting: Taking on too much too soon can lead to content fatigue.

Lack of Planning: Inadequate planning and time management can strain your resources.

Failure to Delegate: Trying to do it all can lead to burnout. Delegate when possible.

Content marketing is a long-term strategy that doesn't yield instant results. Giving up too early is a common pitfall. It's important to:

Set Realistic Expectations: Understand that building a robust online presence takes time.

Stay Committed: Consistency over time is key. Keep pushing forward, even when results are slow.

Social media and search algorithms are continually changing. To remain relevant and responsive:

Stay Informed: Keep up with algorithm updates and adjust your strategy accordingly.

Diversify Platforms: Don't rely solely on one platform; diversify your content distribution.

The internet is saturated with content. To stand out:

Prioritize Originality: Create unique, valuable content that sets you apart.

Niche Down: Focus on specific niches or topics where you can establish expertise.

The absence of measurement and adaptation in your content marketing strategy can lead to missed opportunities. To overcome this:

Leverage Analytics: Regularly measure your content's performance and adapt based on data.

A/B Testing: Continually test and optimize your content to improve engagement.

As a venture capitalist, there are specific regulations and compliance standards to consider when creating and promoting content. Ensure that you:

Stay Compliant: Familiarize yourself with regulations such as the SEC's rules on advertising and solicitation.

In the world of venture capital, the question of whether to focus on building the firm's brand or the personal brands of its partners and team members is a strategic one. Both avenues offer distinct advantages and require careful consideration. This section explores the dynamics of building the firm's brand versus cultivating personal brands within a VC firm and how to strike a harmonious balance.

Building the Firm's Brand

Strength in Unity: A well-established firm brand is a powerful asset. It represents the collective expertise, credibility, and track record of the entire team. Building the firm's brand can create a sense of unity and cohesion that instills confidence in startups and investors alike.

Brand Consistency: A strong firm brand ensures consistency in messaging, which is essential for reinforcing the firm's mission, values, and investment approach. Consistency fosters trust and clarity, making it easier to communicate the firm's unique value proposition.

Leverage Resources: A firm brand often comes with more substantial resources for content marketing, making it easier to maintain a robust online presence. A well-funded marketing strategy can help attract a wider audience and secure higher-quality deals.

Thought Leadership: Personal brands of partners and team members can enhance thought leadership within the industry. When individual team members establish themselves as experts in specific niches, they can contribute valuable insights to the startup ecosystem.

Relationship Building: Personal brands can facilitate one-on-one relationship building. Founders and startups may be more inclined to connect with and trust individual partners within the firm. This can be particularly advantageous in early-stage venture capital.

Varied Perspectives: Personal brands can offer varied perspectives and insights, which can be invaluable in assessing potential investments. Diverse personal brands can bring fresh viewpoints to the table.

Unified Messaging: It's essential to ensure that the personal brands of team members align with the firm's mission and values. Unified messaging helps maintain a consistent image.

Collaboration: Encourage collaboration between personal branding efforts and the firm's content marketing strategy. Team members can contribute to the firm's content while maintaining their individual voices.

Transparency: Be transparent about the relationships between the firm's brand and personal brands. Share the connections between individual expertise and the firm's investment focus.

Strategic Roles: Assign strategic roles to team members, with some focusing on building the firm's brand and others on cultivating their personal brands. This allocation can ensure a balance of efforts.

Assessment and Adaptation: Continually assess the effectiveness of both firm and personal branding efforts. Adapt strategies as needed to optimize results.

Relevance: Localizing your content makes it more relevant to the audience. Users are more likely to engage with content that speaks to their specific geographic needs and interests.

Improved Visibility: Location-optimized content has better visibility in local search results, which can significantly boost organic traffic to your website.

Audience Trust: Targeting local audiences fosters trust. Users are more likely to trust content that demonstrates an understanding of their local context.

Competitive Advantage: Location optimization can give you a competitive edge in local markets, allowing you to outperform businesses that neglect this strategy.

Techniques for Location Optimization

Keyword Localization: Incorporate region-specific keywords in your content, titles, and meta descriptions. Research local search terms and phrases relevant to your business.

Google My Business: Claim and optimize your Google My Business listing. Ensure your address, phone number, and hours of operation are accurate.

Local Citations: Build local citations on online directories and local business listings. Consistency in your business information across these platforms is crucial.

Geotargeting: Use geotargeting in your paid advertising campaigns to ensure your ads are seen by the right local audience.

Local Content*: Create content that addresses local issues, events, or news. This can include blog posts, event coverage, or community involvement stories.

Local Link Building: Collaborate with local businesses and organizations to earn backlinks from authoritative local sources.

Customer Reviews: Encourage customers to leave reviews on platforms like Yelp, TripAdvisor, or Google. Positive reviews can boost your local reputation.

If your firmis targeting mostly Spanish-speaking entrepreneurs from Latin America, there might be a lot of value in publishing and repurposing your content into Spanish.

Multilingual content allows you to tap into international markets and reach a broader global audience, whilst speaking your audience's language fosters a stronger connection and understanding, building trust.

Enhanced SEO: Multilingual content can improve your search engine rankings in international markets, leading to more organic traffic.

Competitive Advantag*: Many businesses overlook the potential of multilingual content, giving you a competitive edge.

By optimizing your content for location and language, you can break down barriers and reach larger audiences around the world while providing a more tailored and relevant experience for your readers and customers. These strategies can greatly expand your reach and impact.

I’m often asked "How much should we invest in content marketing?"

Content will help your firm generate returns up to a point, but once your visibility and brand are at 100, more podcast episodes won’t get you to 110.

The answer lies in balancing the firm’s existing brand and online footprint with it’s fund's size, target audience, goals, and long-term vision.

While there are no hard and fast rules, the following should serve as a starting point to work from, depending on the size of your fund.

For VC funds under the $50 million mark, allocating around 10% of your management fee annually during the capital allocation period (usually 2-3 years) is a good baseline. This translates to $60,000 per year for a $30M fund.

This percentage allows these smaller funds to establish a decent online presence without straining their resources.

As funds grow beyond $50 million, they can start to taper their content marketing investment relative to management fees. Allocating 5% to 8% of the management fee is typically sufficient if paired with an effective data and iteration-driven content marketing strategy.

Allocating 8% of a standard 2% management fee on a $75M fund translates to $120,000 per year. Larger funds have the liberty of spending more on no-stones unturned content marketing campaigns - establishing a presence across all mediums (audio, video, written), and investing in well-researched founder and investor-centric whitepapers and educational resources.

For large firms above $100 million, a range of 3-5% of the management fee should suffice. These larger funds usually have a well-established brand, in-house talent, and a network that supports their deal flow efforts. Content marketing continues to be a crucial tool, albeit at a slightly reduced investment level relative to the overall fund size - which for large funds can be over a billion dollars.

Investing 3% of annual management fee for a $300M fund translates to $180,000 a year.

While content marketing is particularly essential during the fund deployment period, it should not be neglected afterward. Even for larger funds, maintaining a consistent content presence has numerous benefits.

a) Raising Subsequent Funds: VC firms must keep their brand strong, and showcase their expertise and successes to attract limited partners for future funds.

b) Brand Strength and SEO Footprint: Content creation and SEO efforts accumulate over time, strengthening the firm's brand and online presence. Maintaining this footprint is critical for long-term sustainability ad getting more return on investment from your content efforts.

Large VC funds often have the luxury of both in-house and external talent to handle content marketing. They can employ full-time content professionals, engage freelancers, or partner with content agencies. This versatile approach allows them to adapt quickly to changing demands and produce high-quality content.

Conversely, smaller funds may lack the resources or expertise to handle content marketing in-house. Thus, they must collaborate with external partners, such as content agencies or freelance writers, to develop and execute effective content strategies. This external support provides them with the expertise needed to compete with larger players in the industry.

the right content investment strategy for a VC firm depends on its size, objectives, and stage of development.

Smaller funds should allocate a higher percentage of their management fee to content marketing during the deployment phase, while larger funds can taper off slightly.

Regardless of size, consistent and frequent content efforts beyond the deployment phase are essential for brand sustainability.

Content is an investment, not an expense

For every 10 to 20 bets a firm makes, there is the expectation - nay, the hope - that one bet will generate outsized returns, cover losses, and generate target returns to investors.

Y-Combinator - the world’s most iconic startup incubator, has incubated over 4,000 companies since 2005.